Your credit score is the most important indication of your financial situation. It gives lenders a brief overview of your credit utilization patterns. As your score raises, you automatically have a better chance of being approved for new loans or lines of credit. Having a good credit score may also enable you to borrow money at low interest rates or obtain a business credit card.

If you want to learn more about credit rates, feel free to visit FinImpact. Now, let’s get down to action. What are the best ways to improve your credit score fast?

Photo, Dylan Gillis.

#1: Review Your Credit Reports

Your credit report should be your first stop if you want to raise your credit score since it contains the data that forms the basis of your credit score. Your debt, repayment history, and credit management are all included in your credit report. It could also contain details on your past-due bills, any repossessions, and any bankruptcies.

#2: Dispute Credit Report Errors

You are entitled to an accurate credit report, meaning you can challenge inaccuracies on it by contacting the appropriate credit agency, which has 30 days to look into the issue.

Your credit score can be negatively impacted by errors, which can result from data entry mistakes made by creditors, readily swappable Social Security numbers, birthdays, or addresses, or data theft.

#3: Target A 30% Credit Utilization or Less

The percentage of your credit limit that you are now using is referred to as your credit utilization.

The simplest way to keep your credit utilization under control is to pay off your credit card balance in full each month. If you can’t always do it, a good rule of thumb is to keep your total outstanding debt at 30% of your total credit limit or less.

The next stage is to concentrate on bringing it down to 10% or less, as this is what is advised for raising your credit score.

Photo, Sophie Dupau.

#4: Avoid Applying for New Credit Cards

Avoid submitting any new credit applications while you’re trying to restore your credit. The lender will frequently do a “hard inquiry” when you apply for new credit, which is a credit check that appears on your credit report and affects your credit score.

Your degree of risk as a borrower is reflected by the number of credit accounts you’ve established recently and how many hard inquiries you’ve had; therefore, these two factors account for 10% of your credit score.

#5: Eliminate Past-Due Balances

A significant factor affecting your credit is your payment history, which accounts for 35% of your credit score. Your credit score suffers more the longer you go without making payments.

After you’ve cut back on new credit card purchases, use the money you’ve saved to pay off any outstanding balances on your cards before they’re charged off (the grantor closed the account to further usage) or turned over to a collections agency.

#6: Eliminate Your Debt

You’ll need to start paying off that debt in order to improve your credit score because the percentage of your total credit that you’re holding in debt accounts for 30% of your credit score.

Think about the debt avalanche approach and the debt snowball method if you have a positive cash flow, which means you make more money than you owe.

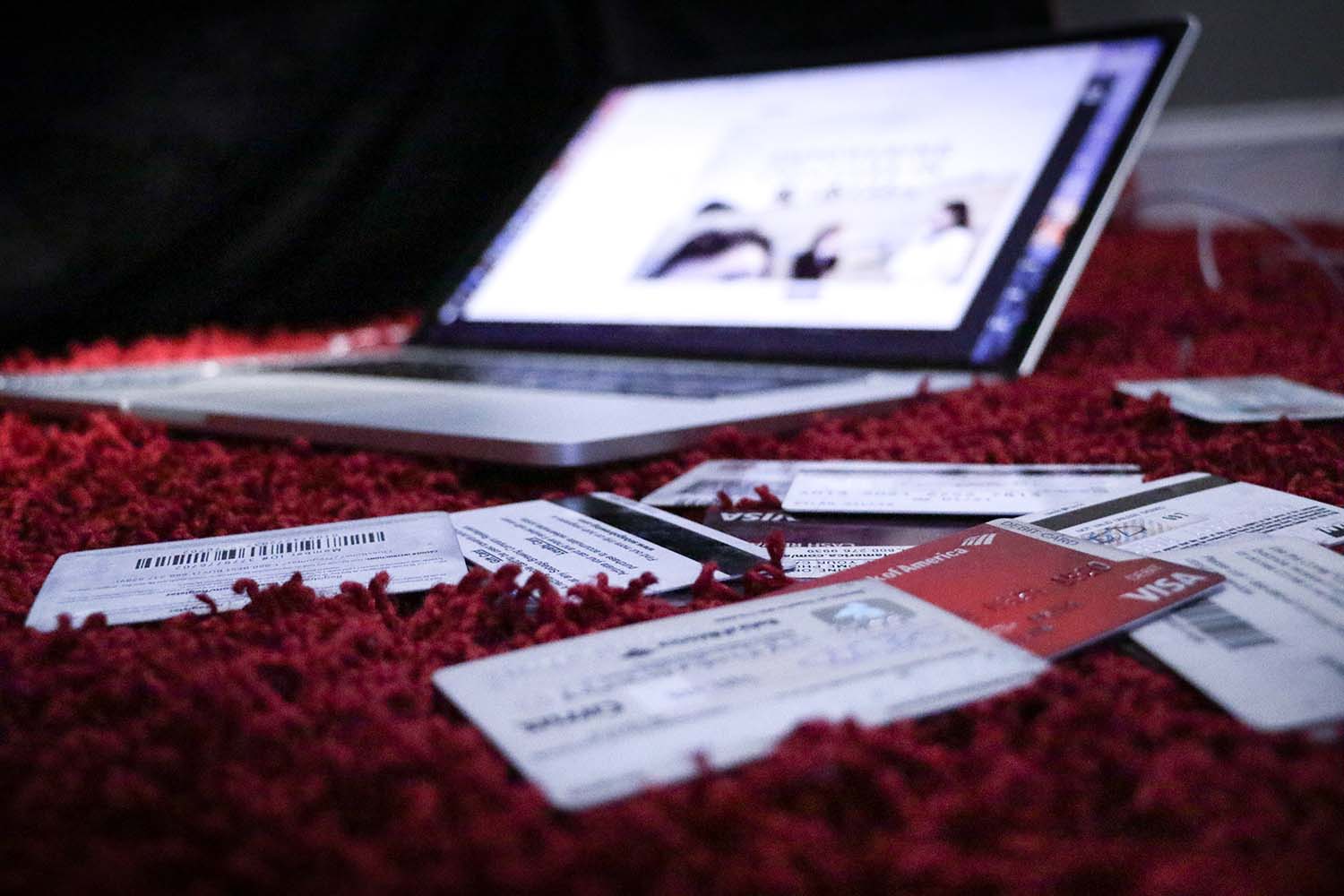

Photo, CardMapr.nl.

#7: Leave Accounts Open

It is uncommon to cancel a credit card to raise your credit score. Make sure that closing an account won’t harm your credit at the bare minimum before doing so. You might be tempted to cancel credit card accounts that are overdue, but the balance will remain on your credit record until it is paid in full. It is advisable to keep the account active and make on-time payments each month to reduce the balance.

#8: Use Credit Monitoring to Follow Your Progress

Credit monitoring programs make it simple to track the evolution of your credit score. These services, many of which are free, keep an eye out for modifications to your credit record, including a paid-off account or a newly created account.

Numerous of the top credit monitoring programs may aid you in avoiding fraud and identity theft.

#9: Take Debt Consolidation Into Account

If you have a lot of unpaid debts, it may be advantageous for you to get a debt consolidation loan from a bank or credit union and utilize it to pay them all off. Since you’ll only have one payment to worry about, if you can get a loan with a lower interest rate, you’ll be able to pay off your debt more quickly. This might improve your credit score and decrease the amount of credit you utilize.

#10: Speak With Your Creditors

Even though calling your credit card provider might be the last thing you want to do, you might be pleased with the assistance you can get. Communicate with your creditors about your circumstances if you’re experiencing problems.

Many companies provide short-term hardship plans that will lower your interest rate or monthly payments while you work on getting back on your feet. They could even be able to come to a mutually advantageous agreement if you let them know you may miss a forthcoming payment.

Conclusion

Raising your credit score is smart, especially if you want to get one of the top rewards credit cards or take a loan to buy a significant item like a new vehicle or house.

However, remember that improving your score may take a few weeks or even months. So, while patience isn’t a component in the calculation of your credit score, it is a quality you’ll need while working to restore your credit.